NIMJN Investigation reveals that 62 political parties failed to pay a combined Rs 3.4 million in taxes. An expert audit — with a director from the Auditor General’s Office — found they skipped paying house rent tax, failed to deposit the 1% social security tax deducted from staff salaries, and dodged other advance taxes.

Read this story in Nepali: कर छलीमा दलहरू

***

“Good governance is our highest priority. The misuse of authority, the exploitation of national and government resources, and corruption will be met with a merciless, strict and zero-tolerance approach. Similarly, monitoring, investigation and scrutiny will be made more effective and any individual who engages in corruption, irregularities, misuse or misappropriation of government property will be brought to justice.”

— CPN (UML) Election Manifesto, 2079

“... Establishing economic good governance is our priority.”

— Nepali Congress Election Manifesto, 2079

“We will not engage in corruption and will not spare those who do.” “... Good governance is for the people.”

— Rastriya Swatantra Party Election Manifesto, 2079

“It is our firm commitment to develop a system of good governance with zero tolerance for corruption, complete transparency and effective service delivery at the doorsteps of the people in line with the principle of separation of powers and the spirit of federalism. This system will also ensure that all tasks, including development work, are completed quickly, efficiently and within a set timeframe. We will always remain steadfast in these commitments.”

— CPN (Unified Socialist) Election Manifesto, 2079

“A system of administration will be adopted that follows all principles of good governance, transparency, accountability and financial discipline, and provides services in a corruption-free and economical manner through digitized government offices.”

— CPN (Maoist Centre) Election Manifesto, 2079

This text is a collection of commitments from the election manifestos of major political parties, which were made public in 2079 BS (2022 AD) before they went to voters' doorsteps to ask for votes for the House of Representatives and Provincial Assembly elections.

Despite emphasizing good governance and transparency before seeking votes, the parties themselves have made a mockery of these principles. The very year they issued election manifestos promising to uphold good governance, transparency, accountability and financial discipline, that is, in the Fiscal Year 2079/080 (mid-July 2022 to mid-July 2023), they evaded taxes owed to the state.

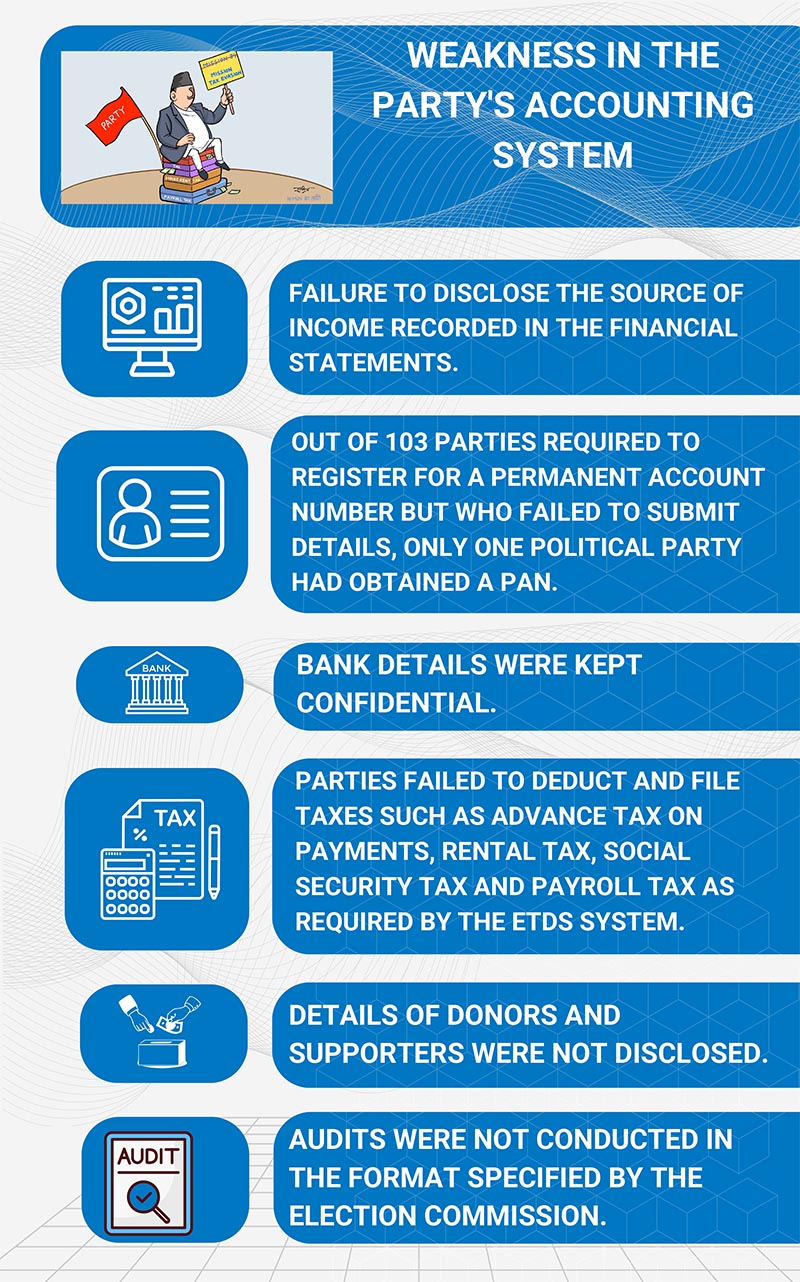

An audit conducted by the Election Commission, with the help of an expert team including a director from the Auditor General's office, on the parties' audit reports revealed that the parties had evaded taxes and that their accounting systems were found to be opaque. This raises questions about the parties' commitment to transparency.

While the audit reports submitted by the parties to the Commission have been made public, the expert team's audit report from the Auditor General's office has not been. However, acting Chief Election Commissioner Ram Prasad Bhandari stated that the Commission has informed the concerned parties about the weaknesses pointed out by the expert team in that report.

The confidential report, which was not made public by the Commission, was analyzed by the Nepal Investigative Multimedia Journalism Network (NIMJN). The analysis found that in the fiscal year 2079/2080 (mid-July 2022 to mid-July 2023), 62 political parties failed to pay a total of 3,409,866 rupees in house rent tax, social security tax and other advance taxes. This total includes 3,066,704 rupees in house rent tax, 309,094 rupees in social security tax, and 34,068 rupees in advance tax and audit fees.

According to that report, political parties have committed irregularities, including maintaining disorganized and non-transparent accounting systems, failing to deposit taxes deducted from the salaries of their office staff to the tax office, and not paying house rent tax.

Major parties also among those not paying taxes

Of the 103 political parties that submitted financial reports to the Election Commission in the Fiscal Year 2079/080 (mid-July 2022 to mid-July 2023), 62 have not paid taxes. These include major parties that have received national party status, such as the Nepali Congress, CPN (UML), CPN (Maoist Centre), Rastriya Swatantra Party, Rastriya Prajatantra Party, Janata Samajwadi Party, and Janamat Party, all of whom were in government at the time. It was in this same year that the House of Representatives and Provincial Assembly elections took place and these parties were granted national party status.

When the audit reports submitted by the parties for the Fiscal Year 2079/080 (mid-July 2022 to mid-July 2023) were reviewed by the expert team from the Auditor General's office, the CPN (UML), which currently leads the government, was found to have evaded the most taxes. According to the report, the UML has not paid 1.83 million rupees in house rent tax and 47,842 rupees in payroll tax, for a total of 1,877,872 rupees in unpaid taxes.

Schedule 13 of the UML's 2079/080 (mid-July 2022 to mid-July 2023) audit report shows an expenditure of 18,383,520 rupees for building leasehold expenses.

After the 2072 (2015) earthquake, the CPN (UML) moved its office to the Pasang Lhamu Foundation building in Dhumbarahi. On April 14, 2021, it relocated to a private rented house in Thapathali. However, citing that building as too small, the UML office moved again on April 22, 2022, to the Tulsilal Memorial Foundation in Chyasal, Lalitpur, where it has remained since.

UML office secretary Bhishma Adhikari stated that the party does not have to pay rent, saying, "We don't pay house rent, so how can we pay house rent tax?"

However, according to Baburam Thapa, the foundation's treasurer, the UML gives the foundation a monthly 'donation' for using the building. "It is not given as rent, but as a donation of 400,000 rupees," he said.

Bishnu Pokhrel, the office secretary of the foundation, also stated that the UML provides the agreed-upon amount to the foundation to cover expenses for building maintenance, research and other projects. The memorandum of understanding regarding the UML's use of the foundation's building for office purposes was signed on October 24, 2021, by then-UML General Secretary Ishwor Pokhrel and the foundation's chairman, Gopal Shakya.

In that year, 2079/080 BS (mid-July 2022 to mid-July 2023), the UML spent 4.584 million rupees on employee salaries. Based on this expenditure, the expert team's report noted that the party had not paid the required taxes and a clarification was written stating that the taxes should be recovered.

Bhishma Adhikari, the UML's office secretary, claimed that the party has no outstanding tax liabilities. We had informed him that the Election Commission, using experts from the Auditor General's office, had prepared a report that indicated there were outstanding taxes.

The next day, he contacted us and said, "The Auditor General's office and the Election Commission should have asked us once before preparing the report. After you informed us, we made inquiries, and only then did we learn about the report with the details of the taxes we were supposed to pay."

He claimed that the one percent tax deducted from employee salaries is submitted monthly.

The expert team also pointed out that the Rastriya Swatantra Party (RASWAPA), which has consistently advocated for good governance in the streets and parliament, has not paid 324,496 rupees in house rent tax and 75,519 rupees in payroll/social security tax, totaling 400,015 rupees.

RASWAPA, which was announced on June 21, 2022, moved its central office from Basundhara to Banasthali on June 22, 2023.

RASWAPA's treasurer, Lima Adhikari, said that the outstanding house rent tax from 2079/080 (mid-July 2022 to mid-July 2023) was paid in the following year. "We have already paid the outstanding tax from the previous year at the ward office," she said. "I cannot show you the exact amount we paid, however."

According to sources from Kathmandu Metropolitan City Ward 16, RASWAPA has been paying 10% of its monthly rent, or 300,000 rupees, as house rent tax since last year (2080/81 BS) {mid-July 2023 to mid-July 2024}.

Clause 6 of Schedule 6 of the Kathmandu Metropolitan City Financial Act of 2078 states that a house rent tax of 10% of the annual rent amount is applicable.

Also, on the list of tax defaulters is the CPN (Unified Socialist), a party led by former Prime Minister Madhav Kumar Nepal and with another former Prime Minister, Jhalanath Khanal, as its esteemed leader. The report notes that it still owes 426,000 rupees in house rent tax and 20,635 rupees in payroll tax. Khem Paudel, a staff member of the party's accounting department, said that the party had paid the outstanding house rent tax for 2079/80 BS (mid-July 2022 to mid-July 2023) on January 14, 2024.

"Whatever tax we owed, we have already paid it," he said.

The audit report for the CPN (Unified Socialist) shows an expenditure of 4.26 million rupees for house rent in 2079/80 BS (mid-July 2022 to mid-July 2023). According to the city's laws, the party should have paid 426,000 rupees in tax. However, according to the tax receipt obtained by NIMJN, the party only paid 360,000 rupees. Its central office is located in Ward 31 of Kathmandu Metropolitan City.

Nepali Congress failed to pay tax deducted from employee salaries for seven years

According to the report prepared by the expert team from the Auditor General's office, the Nepali Congress did not pay 101,145 rupees in payroll/social security tax for the Fiscal Year 2079/080 BS (mid-July 2022 to mid-July 2023).

However, during our investigation, we found that the Nepali Congress had not paid the tax deducted from its office employees' salaries for seven years. Robin Bajracharya, the accountant at the Nepali Congress party office, acknowledged this, stating, "There is a plan to pay the one percent tax from employees' salaries for the last seven years within this year."

The party's audit report shows that the Nepali Congress spent 12,004,500 rupees on employee salaries, wages, and gratuities in the Fiscal Year 2079/080 BS (mid-July 2022 to mid-July 2023). Bajracharya said that even though they were ready to pay the tax last year, they were delayed because a system issue made it unclear how much tax each person owed.

He also mentioned that the Congress party had obtained a PAN from the tax office on June 7, 2023. Bajracharya stated that the party office is aware of the tax issue raised by the Auditor General's office and has kept the amount it is supposed to pay as a liability.

Krishna Prasad Paudel, the chief secretary of the Nepali Congress central office, said that it is possible some taxes the party was supposed to pay were missed. "We haven't received any such information from the Election Commission and it's not like the party would skip paying taxes it owes," he said. "We are ready to pay the outstanding taxes; the party has no intention of evading taxes."

The report also mentions that the Janamat Party, which participated in the 2079 BS (2022 AD) elections for the first time and became a national party, has not paid 78,000 rupees in house rent tax. Janamat Party chairman C.K. Raut said that while the party was aware of the tax it owed, it was delayed due to technical reasons. "We had planned to pay it last year but there were some issues, which caused the delay," he said.

The report also mentions that the Janata Samajwadi Party has not paid 1,275 rupees, while the Nagarik Unmukti Party has not paid 8,750 rupees in taxes, which includes 8,000 rupees in payroll tax and 750 rupees in TDS.

Newly appointed Chairman of the Nagarik Unmukti Party, Lalbir Chaudhary, said he was not aware of the taxes the party owed. "I've just taken on the responsibility, I'll figure out where and how much we need to pay and then we will pay it," he said. Chaudhary was made chairman of the Nagarik Unmukti Party on July 31, 2025, replacing Ranjita Shrestha.

The Rastriya Prajatantra Party (RPP) has not submitted 17,000 rupees in taxes, which is 1% of its employees' salaries. RPP Senior Vice Chairman Dhurva Bahadur Pradhan claimed that no one receives a salary that requires paying payroll tax, so no tax was deducted. "People work as volunteers and only get pocket money," he said. "Except for the security guards, no one receives a salary that requires them to pay taxes, which is why we have not paid them."

The audit report for the fiscal year 2078/79 (mid-July 2021 to mid-July 2022), which the RPP submitted to the Election Commission, shows that the party spent 2.626 million rupees on employee salaries.

What does the law say?

Section 2 (d) (2) of the Income Tax Act, 2058 (2002), mentions that political parties registered with the Election Commission are considered tax-exempt organizations. This same section clarifies that such organizations will not be tax-exempt if they benefit any individual from their property or income, except when making payments for work done according to the organization's goals or for assets or services provided to the organization by an individual.

Rule 23 of the Income Tax Regulations states that any individual required to deduct tax under Chapter 17 of the Act must apply for a Permanent Account Number (PAN) from the Inland Revenue Department before earning income or deducting tax. The expert team's report points out that the parties did not comply with the Act and Regulations by failing to obtain a PAN and neglecting to use the eTDS system to deduct advance tax on payments, social security tax and payroll tax.

The secret report prepared by the expert team from the Auditor General's office states, "Evidence of tax deduction on payments was not presented and in the financial statements of some parties, the amount of advance tax deduction was shown under outstanding liabilities but no evidence of its submission was provided."

Why different laws for political parties and citizens?

Former Acting Auditor General, Sukdev Bhattarai Khatry, said that there should not be a system where ordinary citizens pay taxes while political parties are exempt.

"The same rules that apply to the people should also apply to the parties that lead the country," he said. "Except for exemptions specified in the Financial Act and the Income Tax Act, taxes must be paid. Just because you make the laws in parliament doesn't mean anything goes."

Acting Chief Election Commissioner Ram Prasad Bhandari stated that the audit reports submitted by the parties were not in the format prescribed by the commission. "The parties have submitted their audit reports, but they were not found to be in the format we had specified," he said. "We have already instructed them to make the necessary improvements and it is the parties' responsibility to comply with those instructions." He added that whether the parties have complied with the instructions will only be known from the audit reports they submit the following year.

Bhandari also said that, similar to previous years, they are preparing to have the audit reports submitted by the parties this year re-audited through the Auditor General's office.

Section 40, Subsection 1 of the Political Parties Act, 2073 (2017), stipulates that parties must maintain accounts that accurately show their income and expenses. The Act also states that such accounts can be kept in electronic records. The law mandates that the accounts must be in the format specified by the Election Commission, and the commission must be informed about the officials responsible for the party's accounts.

Similarly, there is a legal provision that allows the commission to demand or inspect the accounts maintained by a party through an officer or expert it designates. Based on the provision in Section 42 of the Act, which allows the commission to verify if a party's submitted report is in the legally prescribed format, the commission has been conducting re-audits through the Auditor General's office for the past two years. "The work the commission is doing to make party accounting systems transparent shows that improvements are being made," said former Acting Auditor General Sukdev.

Eager to impose fines but weak on ensuring transparency

The Election Commission has a history of fining candidates from political parties who fail to submit their election expense reports on time. For instance, the commission published a list of candidates from local level elections who hadn't submitted their expense reports and fined them. According to the list, the total fines amounted to more than 24 billion rupees.

The commission had issued a notice on September 22, 2022, to collect 24.638 billion rupees from 123,650 candidates for failing to submit their expense reports within 30 days of the election results being made public.

After the commission announced that candidates who didn't pay the fine would be barred from participating in elections for six years, many paid up. However, following a writ petition filed by Kathmandu Metropolitan City Mayor Balen Shah, the Supreme Court issued an interim order to the commission on February 16, 2023, to not implement the decision to impose the fines.

On the same day, February 16, 2023, a cabinet meeting recommended to then-President Bidya Devi Bhandari to waive the fines imposed by the commission. Following that recommendation, the President waived the fines on February 17, 2023, under Article 276 of the Constitution.

On March 6, 2024, the Supreme Court also dismissed the writ petition filed by Balen Shah.

The commission has also fined candidates for the House of Representatives and Provincial Assembly elections 15,000 rupees each for not submitting their election expense reports, similar to the candidates in the local elections. The commission levied a total fine of 36,525,000 rupees on 2,435 candidates – 1,037 from the House of Representatives and 1,398 from the Provincial Assembly – at a rate of 15,000 rupees per person. The 61st annual report of the Auditor General has recommended that this outstanding amount be collected.

The confidential report notes that the commission has not been as proactive in getting the political parties to pay their taxes as it was in getting the candidates to pay their fines.

Although the Auditor General's office provided a list of parties that had not paid taxes and the amounts owed, the commission has only informed the parties about the matter.

According to the acting Chief Election Commissioner, the commission has not yet pressured the parties to pay their taxes.

Please adhere to our republishing policy if you'd like to republish this story. You can find the guidelines here.